Your accounting partner

CVW Accounting provides expert, professional accounting services to better Perth businesses now, and into the future.

Creative solutions for financial challenges

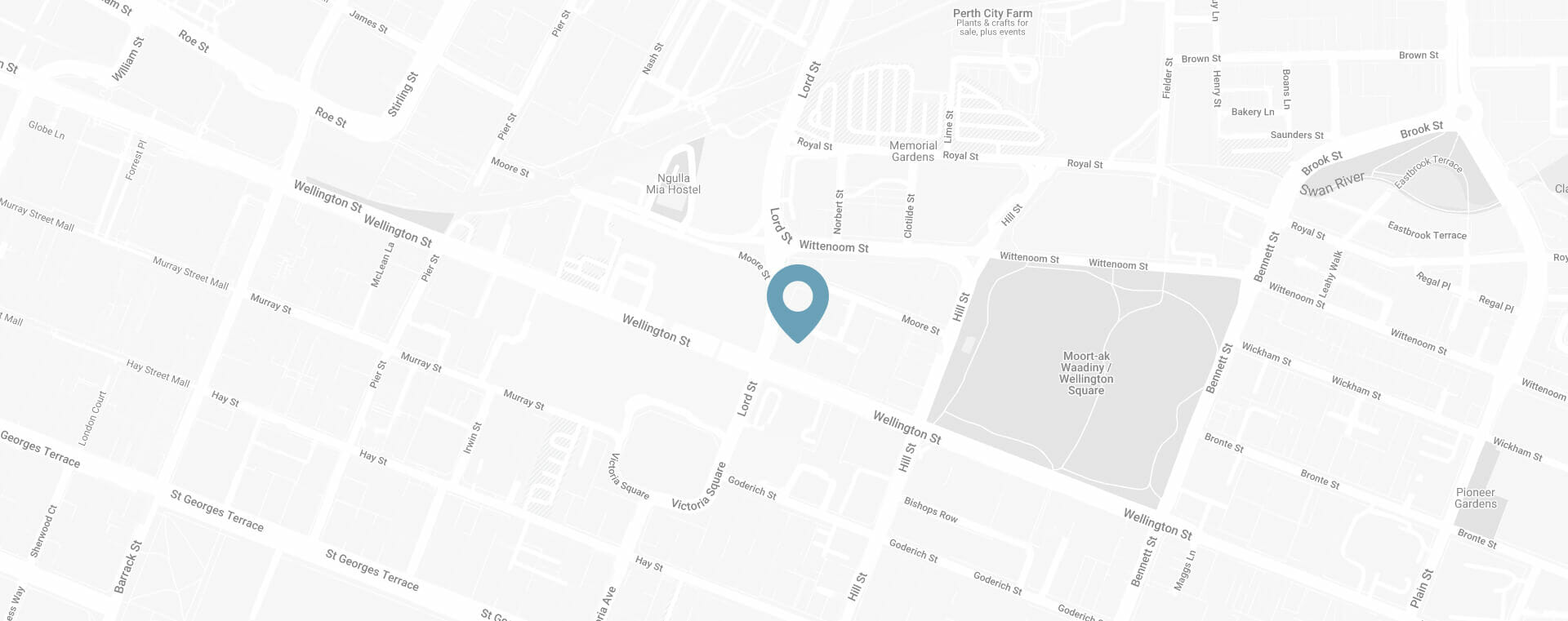

Perth accounting firm

CVW Accounting is a hands-on, forward-thinking accounting practice challenging the norm. Our team of trusted accountants works with your business, as part of your team, to question existing frameworks and strategies that may be stifling growth and success.

What does that mean? We do this by being genuinely interested in the evolution and achievement of you and your business. Together we will alter the way you relate to your business.

Forget reactive accounting practices of the past. There is a world of opportunity in planning for the future. Let us show you what’s possible.

RESULTS

Experienced, honest

Experienced, honest

and successful

Years of experience

Client retention rate

TESTIMONIALS

Our clients

Our clients

success stories

We have been with CVW Accounting for at least five years. The team was a big help sorting out mistakes from our previous company accountant. Stephen is always friendly and available to answer questions and queries. Highly recommend CVW Accounting!

Stephen Vining head of CVW Accounting has been an integral part of my business development, as well as being invaluable when it comes to clearing up outstanding tax returns. Thank you for making my business life easier Mr V.

Such lovely people. So welcoming and friendly. Their knowledge and expertise are second to none, and they have the rare knack of being able to explain it in simple terms.

We have used the services of CVW Group since 1994 for our family business. We have found them to be very professional and they have always acted in our best interests. We can highly recommend them.

Stephen from CVW is one of the most easy going and professional accountants I have used. I have been with his firm for about four years now and will be for many more.

CONTACT US

Start your

Start your

free consultation

BLOG

Latest news & articles

In Australia, there are several commonly overlooked business tax deductions that can help reduce taxable income and lower overall tax liability.

Read more

The intricacies of superannuation compliance are constantly changing and 2023 will be no different. Let’s review and look ahead at some potential superannuation changes that will impact your business. Superannuation guarantee increase It has ...

Read more

October 2023 A business energy incentive legislation is currently before Parliament – what will this mean for small and medium sized businesses? Victoria is introducing an ‘airbnb tax’ but what does this mean to the rest of the country? ...

Read more